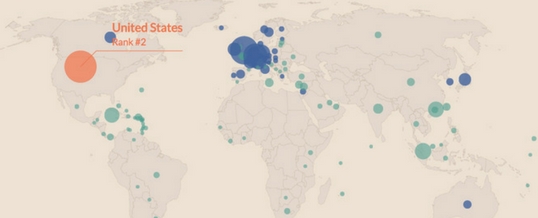

Congratulations, USA – you're now officially the runner-up in the world for financial secrecy!

Previously ranked third (2015) thanks to the massive capital inflow in the past several years, the jurisdiction is sitting nicely at number two, just under Switzerland and above Cayman Islands, Hong Kong, and Singapore in the recently released Financial Secrecy Index.

“But what the ranking signifies? Why should I care?” you ask.

Read on to learn more about the USA as an offshore jurisdiction, and why ranked second just behind Switzerland means that asset owners are on the right track for trusting or planning to trust the US for protecting their assets.

What is the financial secrecy index?

Financial Secrecy Index, published by the Tax Justice Network (TJN), is essentially a list of countries, ranked based on their level of secrecy and the scale of their offshore activities.

The index uses specific formula to score the jurisdictions' involvement in the offshore financial world, which includes the Secrecy Score, the Global Scale Weight, and the FSI Value, as well as FSI Share.

To explain a bit about the factors mentioned above:

Secrecy Score: Grading a jurisdiction's financial secrecy, calculated based on dozens of metrics categorized into Ownership Registration, Legal Entity Transparency, Integrity of Tax and Financial Regulation, and International Standards and Cooperation. The higher the score, the more secretive the jurisdiction.

Global Scale Weight: The percentage of the global offshore market residing in a particular jurisdiction. The higher the percentage, the bigger the offshore sector of a jurisdiction.

FSI Value: Using a formula, taking into account the Secrecy Score and Global Scale Weight. The higher the score, the more secretive the jurisdiction.

FSI Share: The percentage of the global FSI Value owned by a particular jurisdiction. The percentage value signifies the same thing as FSI Value and Secrecy Score.

Here's the Top 10 List

The state of financial secrecy in the US

The Top 10 list is a useful list, showing you the who's who in the world of offshore secrecy. This effectively means that securing your assets in one of those jurisdictions would be highly beneficial in your financial plan. However, in this article, we'll focus on the USA for one reason: The jurisdiction is not traditionally known as being a tax haven, but in reality, it's actually one of the biggest and strongest in the world, with a long history of secrecy at the Federal level, dated back to 1920s.

The media was buzzing, covering the USA's “achievement” in improving it's ranking in the financial secrecy index. Many see this as a threat to the global tax transparency effort, but for asset holders, this means opportunities.

What's interesting is the US' scores if we look at those individually.

US Secrecy score: 60

If you look closely, the US' secrecy score is actually not that high; The US scores 60 out of 100, ranked in the bottom half of the 112-country list. The score means that the US is only moderately secretive, thanks to the high integrity of the US tax and financial regulation (with the IRS and DoJ, you can't go wrong)!

The biggest selling point in term of secrecy is the lack of legal entity transparency and the secretive nature of the ownership registration. Indeed, setting up your company in Delaware, Wyoming, Dakota or other low-tax US states means that you're taxed minimally (up to zero percent) and your incorporation details won't appear in the public record. Plus, due to the strong laws and regulations, your offshore company is well-protected in the U.S.

But this 'so-so' score alone won't make the US an attractive jurisdiction for offshore asset holders. The following figure is what 'crowning' the US runner-up.

US Global Scale Weight percentage: 22.3%

In essence, the US jurisdiction holds 22.3 percent of the global offshore financial services market. That's an enormous figure. To compare, the UK ranks second with 17.36 percent, followed by Luxembourg (12.13 percent) and Germany (5.16 percent).

This market share percentage is what propelled the US from third in the 2015 list to second in the latest list. Consider this: Between 2015 and 2018, the US' offshore market share jumped by 14% to 22.3% - which essentially means that during that 3-year period, the US snatched 14 percent of the global offshore financial services market from other jurisdictions.

But why the sudden jump in market share? One of the biggest reasons is the US' reluctance in sharing the data of foreign asset holders who are securing their assets in the US, while demanding other countries to surrender the US citizens' account information to the US through various methods, including suing overseas banks for trying to protect their US clients data.

Takeaway

Due to the factors explained above, the US is a very attractive jurisdiction for non-US asset holders to stash their wealth. Low-tax US states, such as Delaware and Wyoming, boast ease of company setup, top-notch secrecy, and low-taxation.

But what about the US citizens? For them, it's probably better to repatriate their assets than keeping those overseas. Since most offshore banks avoid, even snub them, what choices do they have?

So, here's your next step: If you're thinking of the US as the best jurisdiction for you, then you need to these things: Learn as much as you can about low-tax US states and consult with your trusted lawyers. You should also consult with an International corporate service provider to learn more about the US, including the technical aspect of getting incorporated in a particular US state.

Read also "Offshore Company Definition and How It Works"

FEB

2018

Table of Contents