Safety is paramount when it comes to banking. Technology has revolutionized the way the global banking market operates.

The Global Finance magazine is the leading authority on the world’s safest banks for the last two decades. It has been releasing the annual ranking of the top 50 safest banks in the world. Some of the leading global banks have managed to retain their position on the list while others have either gone up or down in the rankings in 2020.

European Banks continue to dominate the list of the safest banks in the world. The Top 10 banks are all European. Asian Banks have also done particularly well with a number of them featuring in the top 50.

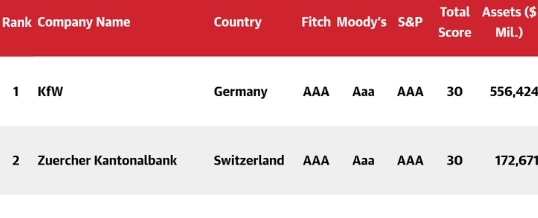

According to the Global Finance magazine, here are the world’s safest banks:

1. KfW (Germany)

KfW is one of the most significant state-owned banks in Germany. Its largest subsidiary is KfW Forderbank, which provides financing for environmental projects, housing, and now student loans. KfW, adjudged the safest bank in the world, is not bereft of controversies. Despite accidentally transferring €300 million to the Lehman Brothers on the day they filed their bankruptcy, the bank has managed to retain its position. KfW holds assets worth an astounding $556 billion.

2. Zuercher Kantonalbank (Switzerland)

The Zuercher Kantonalbank is one of the largest Swiss banks, primarily specializing in investments, mortgages, private lending, and pensions. The bank has been in operation since 1870 and holds assets worth nearly $173 billion.

3. BNG Bank (The Netherlands)

Established in 1914, the BNG Bank has gone up two spots compared to last year. The BNG works exclusively with public and semi-public companies and does not provide funding to private companies. It is one of the leading banks in the Netherlands, with 50% shares belonging to the Dutch state and the remaining to the municipal and provincial authorities.

4. Landwirtschaftliche Rentenbank (Germany)

The Government of Germany acts as the guarantor of this bank, which clearly shows its importance in the country. The Landwirtschaftliche Rentenbank is quite well-known for providing loans to the agricultural industry in the country at quite a low- interest rate. The bank raises its funds through global capital markets and then invests it in private businesses in the agricultural sector in the country. It currently holds assets worth $103 billion.

5. L-Bank (Germany)

The L-bank was founded in 1998 and is well-known for providing funding to the construction and infrastructure sectors of Germany. The most famous among its projects are the technology hubs in Tubingen, Stuttgart, and Mannheim. Its total assets amount to over $79 billion.

6. Nederlandse Waterschapsbank (The Netherlands)

As the name suggests, the Nederlandse Waterschapsbank initially specialized in providing financing solutions to water boards in the Netherlands. It has now extended its services to education, public housing, and environmental projects. The bank currently holds assets worth just over $86 billion.

7. Kommunalbanken (Norway)

The Kommunalbanken is wholly owned by the Govt. of Norway on behalf of the King of Norway. The bank is strictly regulated and only provides funding to Norwegian Governmental authorities. Its total assets have been reported to be around $48.5 billion.

8. NRW.Bank (Germany)

The NRW.Bank is owned by the state of North Rhine-Westphalia and operates as a public institution. The bank provides funding solutions to the political and economic projects of the state. It holds assets worth over $169 billion.

9. Swedish Export Credit Corporation (Sweden)

Better known as SEK, it is wholly owned by the Swedish Govt. The bank primarily provides financing for large and medium-sized Swedish exporters, the most famous one being Volvo. It lends in over 70 countries with a strong emphasis on sustainable financing and corporate social responsibility.

10. Banque et Caisse d’Epargne de l’Etat (Luxembourg)

Established in 1856, the bank is wholly owned by the Govt. of Luxembourg. It was incorporated as a savings bank in the beginning but went on to become a full-service banking institution in 1944. It is one of the largest financial institutions in Luxembourg, with assets worth over $51.2 billion.

What is the methodology behind the rankings?

The Global Finance magazine rankings apply to the 500 largest banks in the world based on asset size. Rankings are influenced by the long-term foreign currency ratings issued by Moody’s Investor Services, Standard & Poor’s, and Fitch Ratings. Banks that are completely owned by other banks are excluded from the list.

Banks are ranked according to asset size for the most recent annual reporting period provided by Fitch Solutions and Moody’s. A point system is used to determine the ranking, with more points being rewarded for better credit-rating.

Why are offshore banks better than US banks?

The Global Finance magazine's annual ranking of the World’s Safest Banks easily debunks the myth that offshore banks are not safe. European and Asian banks have emerged as the safest banks globally.

There are just four US banks in the list of the Top 50 safest banks in the world and none in the Top 10. The four US banks in the Top 50 are Agribank (at number 41), CoBank (at 45), AgFirst (at 48), and Farm Credit Bank of Texas (at 49).

If you are still unsure about offshore banking, here is why you should open an offshore bank account now:

- It reduces your political risks. Your money is safe from being devalued, frozen, or confiscated. Money in an offshore account is free from any capital controls imposed by the US Govt.

- Offshore banking services offer more diversity to the customer, better investment opportunities, tax benefits, perks, and, most importantly, secrecy. Offshore banking is extremely beneficial to individuals with a high net worth.

- Offshore banking allows currency diversification to diversify your portfolio risk.

- Offshore banks provide higher returns for your deposits. The earnings that you are receiving on your savings in the US is not keeping up with the real rate of inflation.

- A bank account offshore is like an insurance policy against unsound banking systems. It keeps you away from frivolous lawsuits, and you can also pay for medical care abroad. In short, an offshore bank account gives you much-needed peace of mind.

Conclusion

Despite what you may hear, it is completely legal to have an offshore bank account. It is not about evading your taxes or other unlawful activities.

Offshore banks have far more sound banking systems than your onshore banks. These banks tend to be conservative in leveraging your assets to make money. Hence, they are much more responsible than your onshore/local banks.

Your money should be truly safe in the hands of your bank, and you must be able to access your money 24/7. Hence, to keep your money safe from any political turmoil in the US, you must have an offshore bank account.

AUG

2020

Table of Contents