It's already widely reported that tax havens are where some of the wealthiest people of the world stash their assets. Rightly so, tax havens are 'slapped' by many labels – usually negative ones.

The place for criminals, corruptors, tax evaders and money launderers to hide their money. The place for people who want to keep their money away from unwanted family members. The place for companies to stash their wealth and pay very low taxes.

There's actually one more label: Tax havens are known as the cause of capital flight.

In this article, we'll talk about how tax havens are considered as the cause of capital flight. Read on.

What is capital flight, anyway?

There are several definitions of capital flight, but in this article's case let's define it as the movement or transfer of capital from one jurisdiction to other jurisdictions.

The reasons for a capital flight are usually related to the changes in financial policies, rules and regulations of the jurisdictions where your assets reside, in such a way that these put your assets into trouble (e.g. unfavorable situation).

The reasons may also be related to macroeconomic shifts, such as political turmoil and economic downturn. Other reasons may be related to asset owners' personal situation, such as pursuing offshore investment opportunities, lowering tax liabilities or simply hiding your assets from your competitors, family members, or even tax men.

What becomes a major issue with capital flight is the funds' origins. Capital flights are the culprit for the struggles faced by developing countries.

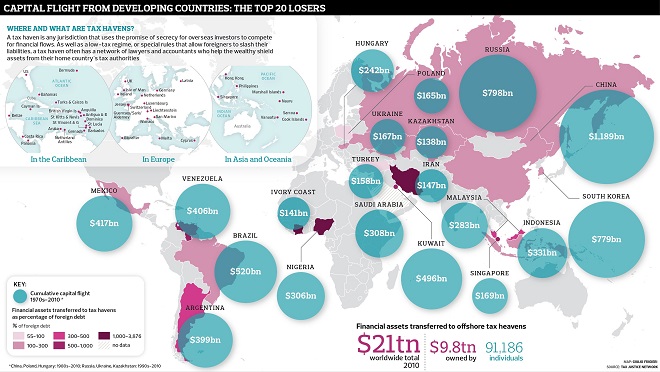

Check out this infographic:

As we can learn from the top 20 losers, most are considered as developing countries. And it's really tragic given the fact that the correlation between foreign debt figures and the size of capital flight is high.

But is it really tax havens that are the cause of the capital flight?

Tax havens – the culprit (or not?)

Tax havens – defined as the jurisdictions that boast secrecy and low taxation. Jurisdictions like UK, The Netherlands, Belize, Singapore, Hong Kong and many other countries fall into the “tax haven” category.

But people tend not to observe both sides of a coin. Indeed, what many people don't realize (or don't have the right information or even misled) is that a number of tax havens are attractive for several other reasons, namely:

- - Sound banking system

- - Stable political and economy climate

- - Fairer tax rules and regulations

While, say, Nauru, Grenada or any other island tax havens, isn't really considered as fundamentallly sound, jurisdictions like Singapore, The Netherlands and Switzerland are some of the best offshore financial centers in the world with banks that are stronger than banks in most western countries.

Now, asset owners who move their assets to offshore jurisdictions may have different reasons as mentioned above, but why blame tax havens for the problems developing countries have?

Let's put it this way: If cars were the cause of accidents on the street, should we really ban cars from the street? No, the drivers need to be held responsible. Then, how about the street signs? Are they visible enough to help drivers avoid accidents? How about the road conditions? How about the weather conditions causing poor visibility and car control – e.g. Snow storm?

You see, there are factors that contribute to traffic accidents.

Going back to capital flight – we think that it's unfair to blame tax havens for all the problems developing countries have.

What about the asset owners themselves? While some are wrong-doers, some others are just want to protect their hard-earned money better.

What about the local factors, such as the developing countries' corrupt governments? What about the political instability of the jurisdictions? What about the strangling policies that limit personal financial freedom and the free market?

Takeaway: Why those matter

There are many takeaways from the whole notion of tax havens causing capital flight discussed above. You might ask, “why do those matter?”

Firstly, people need to learn to view things from two sides, as – whether you like it or not – there are always two sides of a coin. There are always pros and cons. Seeing things from one side only causes a tunnel vision, missed opportunities, and misinformation. In term of taxation, you should know why tax havens are well sought after, and why people would want to go through all the legal troubles for setting up accounts and/or forming companies offshore. Only then you can see that capital flight is often inevitable.

Secondly, we need to read publications from the media with an open mind and critical eyes. Know that the voices of the media may be subjective or even fake. You need to be able to identify reputable sources of things, and that includes the topics of tax havens, capital flight, and everything else in between.

Thirdly, we need to understand that people – including you and I – (should) want to be treated fairly, especially in term of taxation. We've discussed in another article about the best jurisdictions for our assets, and one of the factors to consider is taxation policy. Generally speaking, countries that adopt territorial tax policy are the ones that treat your fairly: You only need to be taxed for income generated from the jurisdiction. Now that's fair. And some tax havens can offer you just that, which is one of the strong reasons for capital inflow to such jurisdictions.

So, what's your stance?

There is no right or wrong in this matter. Instead of pointing fingers or forcing our opinions with each other, let this article sparks a discussion or debate if you will.

OCT

2017

Table of Contents